These errors can occur when users input the wrong numerical figures into accounting software, which can then propagate through various financial statements and reports. Inaccuracies in recording transactions and failing to reconcile accounts can also contribute to transposition errors. Modern accounting and financial reporting have been revolutionized by the advent of sophisticated software and analytical tools designed to detect errors in balance sheets and other financial statements. These tools range from basic accounting software to advanced financial analysis platforms that use artificial intelligence (AI) and machine learning algorithms.

How to Locate and Rectify Transposition Errors

In this comprehensive guide, we will explore the definition of transposition errors, their common what is one way to check for an error caused by transposed numbers? types, causes, and consequences. We will delve into how these errors can impact financial statements, company finances, and even lead to legal issues. We will discuss methods for identifying and correcting transposition errors, along with real-life examples in the finance industry. We will provide practical tips for avoiding these errors in the first place.

Effect on Accounts

- If they are unequal, you can go back to your journal entries to find where the error originates from.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Addressing these challenges requires a keen focus on accuracy, transparency, and robust validation processes within the accounting and bookkeeping practices.

- Transposition errors, while seemingly minor, can have far-reaching consequences if left unchecked.

- That is called a transposition error, and is very common for reasonably speedy touch-typists.

- In this comprehensive guide, we will explore the definition of transposition errors, their common types, causes, and consequences.

At the end of the month when it’s time to balance the payroll accounting books and get ready for the next accounting period, one of the first steps is compiling a trial balance. These errors often result from inadvertently swapping digits when recording numerical data, such as in accounting or financial reports. The repercussions of such errors can potentially misrepresent the financial health of an entity, affecting its ability to make informed strategic decisions. Understanding Transposition Error is crucial in the realm of finance and accounting, as it pertains to the incorrect arrangement of numerical values, often resulting from data entry mistakes.

Real-Life Examples of Balance Sheet Errors and How They Were Detected and Corrected

By addressing these errors, the integrity of financial records is maintained, providing reliable information for decision-making and regulatory compliance. Misclassification errors happen when an item is incorrectly categorized as an asset, liability, or equity. For instance, a short-term loan might be mistakenly classified as long-term debt, skewing the company’s debt profile and affecting liquidity ratios. This type of error can mislead stakeholders about the financial structure and risk profile of the company.

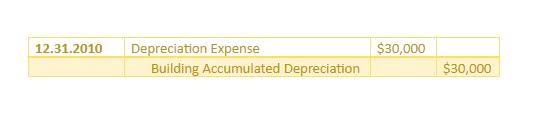

These errors underscore the necessity for meticulous attention to detail in financial reporting, highlighting the importance of accurate balance sheet preparation and analysis. Trial Balance shows the debits and credits, while a ledger is used for recording details of individual transactions. First of all, if a transaction is correctly entered in the journal but one of the accounts is not posted to the ledger, the trial balance will show disagreement. It’s important to establish a routine where you review and carry out reconciliations of your accounting records on a regular basis. That said, accounting errors will still happen no matter how thorough and frequent your reviews.

Do you already work with a financial advisor?

To correct an erroneous transaction, you’ll need to record an additional transaction involving the same accounts. Errors in original entry are identified when a transaction recorded in the subsidiary book is posted to a wrong account or in a wrong column in the ledger. The amount will not tally with that of the initial transaction and subsequent entries made afterwards in the same journal or subsidiary books. There are many ways to prevent and spot accounting https://www.bookstime.com/ errors before they can slow you down. To avoid accounting errors, use bookkeeping best practices and always double-check your work. Reconciliation errors are discrepancies between your books and your bank account statements.