Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. The third entry requires Income Summary to close to the RetainedEarnings account. To get a zero balance in the Income Summaryaccount, there are guidelines to consider. An accounting year-end which is not the calendar year end is sometimes referred to as a fiscal year end. With the use of modern accounting software, this process often takes place automatically.

- There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again.

- The fourth entry closes the Dividends account to Retained Earnings.

- No matter which way you choose to close, the same final balance is in retained earnings.

- You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app.

- The third entry closes the Income Summary account to Retained Earnings.

Which types of accounts do not require closing entries?

This means that it is not an asset, liability, stockholders’ equity, revenue, or expense account. The account has a zero balance throughout the entire accounting period until the closing entries are closing entries prepared. Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements.

How do you close revenue accounts?

- Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

- Now Paul must close the income summary account to retained earnings in the next step of the closing entries.

- Retained Earnings is the only account that appears in the closing entries that does not close.

- The Philippines Center for Entrepreneurship and the government of the Philippines hold regular seminars going over this cycle with small business owners.

- An accounting period is any duration of time that’s covered by financial statements.

- ABC Ltd. earned ₹ 1,00,00,000 from sales revenue over the year 2018 so the revenue account has been credited throughout the year.

Using the above steps, let’s go through an example of what the closing entry process may look like. Printing Plus has a $4,665 credit balance in its Income Summary account before closing, so it will debit Income Summary and credit Retained Earnings. However, if the company also wanted to keep year-to-date information from month to month, a separate set of records could be kept as the company progresses through the remaining months in the year. For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. In this chapter, we complete the final steps (steps 8 and 9) of the accounting cycle, the closing process. This is an optional step in the accounting cycle that you will learn about in future courses.

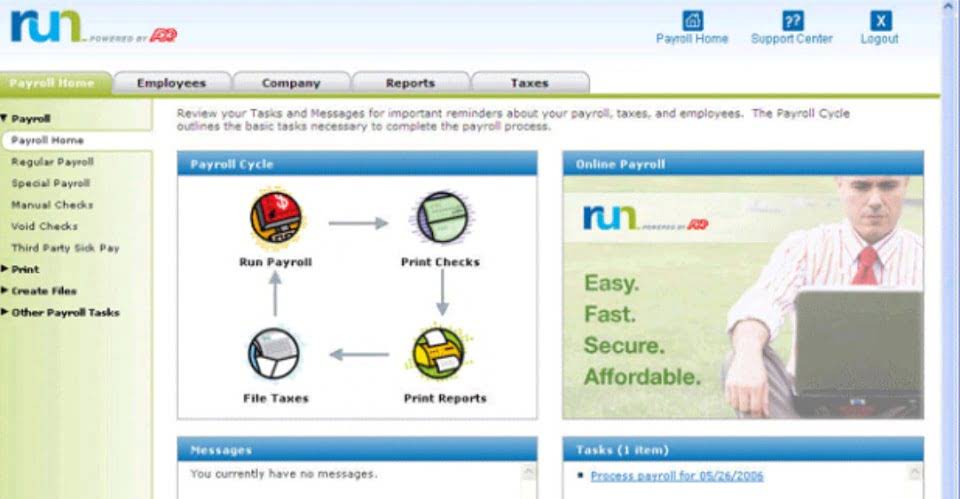

Closing Entries Accounting with Automation

Forget to close one account, and you’ve thrown off the entire reporting process. Now, if you’re handling accounts for a larger firm, the stakes get even higher. Say you’re running a freelance design business and have earned $50,000 in revenue this year. By the end of the year, you’ve made $100,000 in revenue and incurred $60,000 in expenses. https://www.bookstime.com/ If they aren’t reset, you could easily mix up past and future numbers, leading to confusion and inaccuracies in your financial reports. This comprehensive accounting glossary defines essential accounting terms.

- Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period.

- In addition, if the company uses several sets of books for its subsidiaries, the results of each subsidiary must first be transferred to the books of the parent company and all intercompany transactions eliminated.

- That’s why most business owners avoid the struggle by investing in cloud accounting software instead.

- Let’s explore each entry in more detail using Printing Plus’s information from Analyzing and Recording Transactions and The Adjustment Process as our example.

- Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period.

- The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders’ equity section of the balance sheet.

Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time. This gives you the balance to compare to the income statement, and allows you to double check that all income statement accounts are closed and have correct amounts. If you put the revenues and expenses directly into retained earnings, you will not see that check figure. No matter which way you choose to close, the same final balance is in retained earnings.

This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data. The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor normal balance 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food.